Join a Syndicate of Acquisitions Experts and Passively Multiply Your Net Worth

The chance to invest in multiple profitable businesses alongside the largest community of mergers and acquisitions entrepreneurs in the world

Trusted by

Our strategy gives accredited investors access to tremendous deal flow that is traditionally limited to very few of the wealthiest investors

Track Record

We have 100+ transactions in just the past 3 years

Winning Strategy

We only acquire profitable companies led by world-class founders

How It Works

What is Acquisitions.com?

We are a group of highly motivated M&A entrepreneurs. We know that over 90% of startups fail within the first 5 years. That's why we strongly believe that merging profitable and established businesses is the way forward.

We’ve been doing this for years, and as a result:

We built the largest community

of Mergers and Acquisitions entrepreneurs in the world

We receive thousands of applications from small business owners every year who want to work with us

Our Acquisitions Strategy

We buy smaller companies that have been profitable for years, consolidate them into one larger entity, optimize their internal operations, and take this entity public.

For Small Business Owners

They get to grow their business alongside experts and eventually go public with us

For Our Investors

They get to invest in a cherry picked portfolio of profitable companies with almost no downside

Our Current Focus

We are currently focused on acquiring and merging profitable companies in the digital marketing sector.

Why Digital Marketing?

The entire world is moving online after the lockdown

Demand for better online marketing will never stop

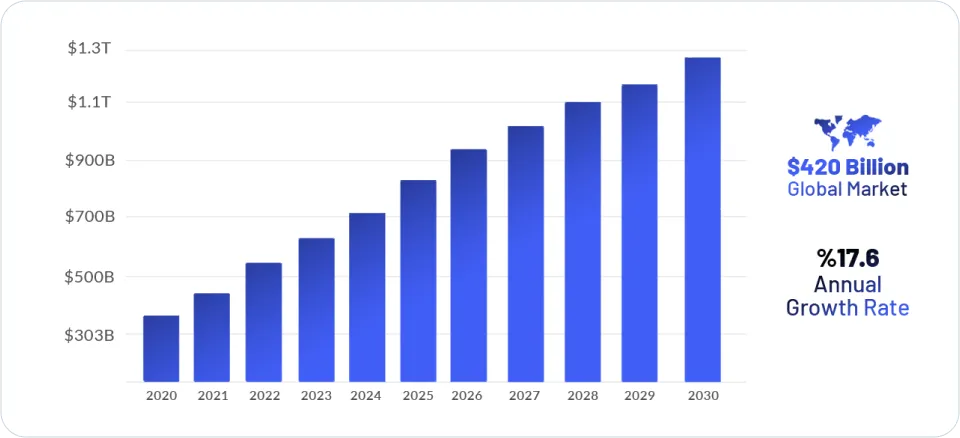

The industry is growing at a CAGR of 17.6% expected to reach $800B+ by 2026

Society is still only 13% digital which means the market is far from saturated

The Digital Marketing Industry

Our Unique Market Edge

How We Choose Companies

Our network gives us access to companies that have already been profitable for years and still have lots of potential

Why Companies Choose Us

We take the stress away from our partners by handling their operations while they focus on their creative expertise

By merging multiple profitable companies and allowing the founders to focus on what they’re great at, we both eliminate the downside and maximize the upside for our investors.

Why Now

Digital Marketing is expected to reach a $500 Billion market cap by the end of 2022 and close to a Trillion by 2026

All signs point toward the market going from horizontal to vertical very soon which is the best time to invest

Our Track Record

More than 120 deals closed

Deal size $500k-$40M

$550M in revenue

9 countries and over 25 industries

Meet the Founder

Moran Pober

Moran has founded, advised, sold, or played an integral role in the exits or acquisitions of over 100 companies, such as Werribee Panels, Forward Freight Systems, Rittenhouse Book Distribution, S4Films, Community Home Services and others.

Moran has 15+ years of entrepreneurial experience, served as a General Partner at WeKix Israel Venture Funds and acquired iTips Group.

As an entrepreneur, Pober has founded and acquired several companies, including a UK-based professional services firm, a US-based media, news and entertainment company, a Canadian based digital solutions Talonx.

Moran is now the founder and CEO of Acquisitions.com, a leading marketplace for buying and selling businesses with the vision of creating a world where anyone who has the drive and desire, can fulfill their dream of entrepreneurship, through acquisitions.

FAQ

What makes (name of company) a better option than its competitors?

What makes (name of company) a better option than its competitors?

What returns can I expect from investing with (name of company)?

What makes (name of company) a better option than its competitors?

Why is now the time to invest with (name of company)?

What makes (name of company) a better option than its competitors?

When do I start seeing returns?

Suspendisse accumsan blandit erat, non iaculis lectus porta sed. Quisque sed massa vitae nibh placerat elementum finibus sit amet nunc. Suspendisse dapibus bibendum nibh non sodales. Aenean a ex urna. Aliquam tincidunt eu purus id posuere. Duis mi nulla, malesuada ut metus quis, laoreet bibendum odio. Aliquam ut lorem velit. Donec convallis lacus risus. Vestibulum efficitur mauris et facilisis maximus.

Any investor wants 1, 2, 5, 10, or even 100x on their capital.

But what investors want and what they get usually don’t align.

Investors are left wanting for more.

They want higher returns, lower risks, shorter exits. They want to see the money start rolling in.

And the worst thing about investing?

You have so many options, and by the time you figure out and discover that all of them are going to leave you wanting more, you’ve already sinked in precious time that you can’t get back, you’ve already earned mediocre returns on money that you could have invested elsewhere.

But in reality, investing elsewhere probably wouldn’t have made that much of a difference.

You’re always sacrificing something.

You invest in the stock market and you sacrifice the safety of your investments in return for volatility.

You invest in real estate & limited partnerships, you see average returns of 8 to maybe 12%.

You gamble with IPOs in a Robinhood account, and you get burned.

There isn’t really any right answer or direction as to what should you invest in.

And don’t think that this is just me talking from an abstract or 3rd person perspective.

I know all this, I know all the obstacles you’ve probably faced, because I was in the same exact position as you.